Introduction

Our Werk…

With over 25 years of hands-on experience in the development of Engineering Solutions, Trading Platforms and Quantitative Algorithmic-driven Investment Systems, ForthlineFX (Forthline, LLC) is a specialist Systems developer committed to innovation, performance, and quality. To learn more, watch our introduction video bellow…

Your Automation Specialist

Our Services…

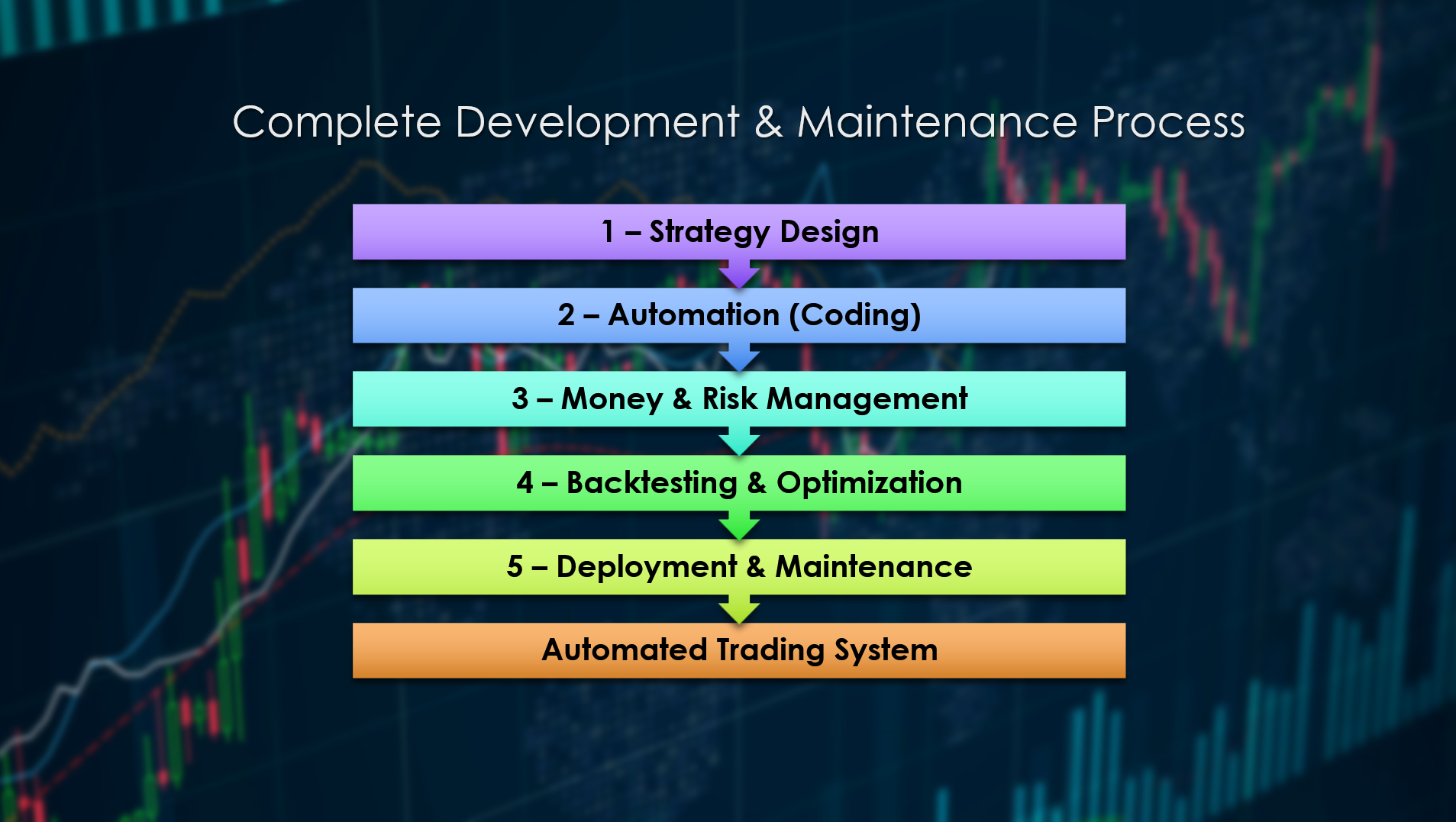

We focus in all phases of the development, testing, fine tuning and deployment of automated investment strategies.

STRATEGY DESIGN & EA PROGRAMMING

Every Investment Strategy starts with a new idea based on the detection and understanding of patterns and relationships in the underlying market conditions. We can help you in this initial design phase using our proprietary Data Mining, Quantitative/ Technical Analysis and AI methods. So, before you even start coding your EA, we can already ensure that its underlying strategy is feasible and profitable.

Once your Investment Strategy has been designed, we can help you code your Automated Investment System (aka: Expert Advisor – EA) for a proven industry trading platform, such as MetaTrader (supported by all main FX brokers and ECN’s).

BACKTESTING & OPTIMIZIATION

Automated systems need to be correctly backtested against past market data to gauge its accuracy and effectiveness. At this phase, we can help you report & validate the performance of your automated system. Next, we can also help you in optimizing and implementing the necessary code/strategy changes to your EA. Only then, can you gain the confidence that your algorithmic system is ready for life trading and will be profitable on the long run.

DEPLOYMENT & MANAGEMENT

Automated algorithmic systems need to be deployed in a safe, reliable and fast environment. They also need to be monitored and maintained, otherwise despite having a profitable underlying investment strategy, they can cause profit degradation and abrupt losses. In partnership with AMAZON AWS-Services, we have experience in setting up and managing solid cloud-based VPS’s tailored for the MetaTrader platform.

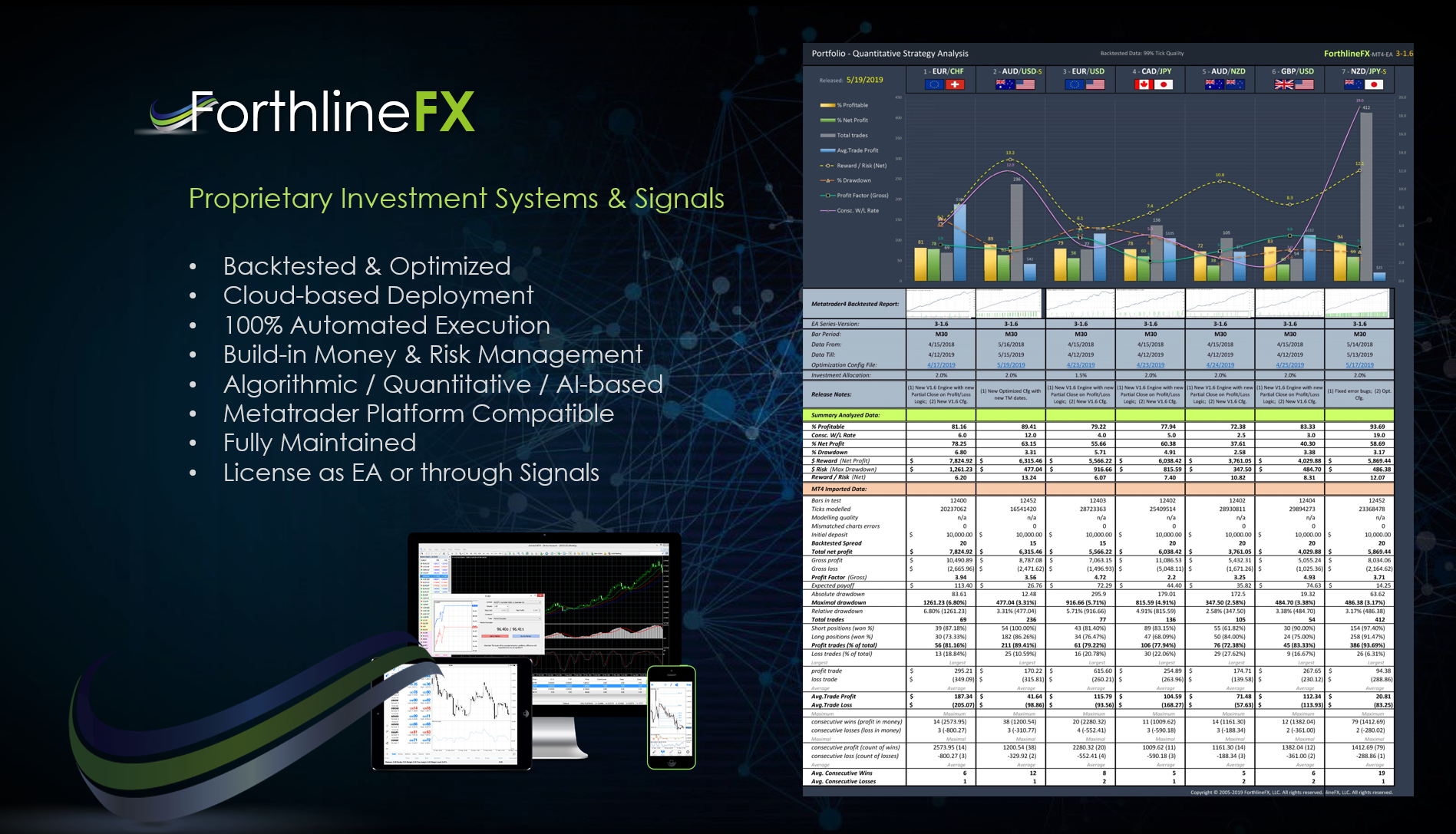

PROPRIETARY TRADING SYSTEMS & SIGNALS

For high-end, accredited non-institutional Investors that don’t want to stress about the development and maintenance of their own EA’s, ForthlineFX also licenses and manages our own proprietary Automated Investment Systems & Signals.

These tested EA’s can be licensed for direct execution on the clients host, or on our servers for a reliable and secure performance.

We got you covered.

Supporting every Area of your Strategy

From Design, Coding, BackTesting, Optimization all the way to Production, we cover it all.

Experience & Tools

Our Skills…

The development and management of modern, cutting-edge Algorithmic-based Automated Investment Systems, requires a broad set of skills and technology tools. At ForthlineFX, we have acquired these pre-requisites over many projects and R&D cycles. So, no matter which services you require in this highly specialized investment sector, we are confident we can assist you with great solutions and services.

Software Programming

Automated Trading Systems rely on specialized software code that is executed within a particular Trading Platform, such as MetaTrader. These programs retrieve and analyse the market data in real-time, making independent buy and sell decisions on investment instruments. At ForthlineFX we have accumulated an extensive experience in the development of complex IT solutions – not only for the Financial world, but also for Engineering and Manufacturing. Consequently, our Systems are well designed, reliable and efficient.

Technical Analysis

Technical Analysis is a form of market analysis based on historic price patterns. The basic assumption of technical analysis is that human behavior does not change over time, and thus similar historic market behavior will lead to similar future behavior. Technical Analysis is a predictive form of analysis, where a technical analyst will try to estimate what the market might most probably do over the next period of time. It uses indicators and patterns.

Quantitative Analysis

Like Technical Analysis, Quantitative Analysis (quants) is based on historic price data. Quantitative Analysis however, is based on sound scientific and statistical principles. It might make use of the same indicators as Technical Analysts do, such as: Moving averages, Oscillators, etc., but it also might use Artificial Intelligence (machine learning, neural networks, genetic optimization, …), and all kind of Statistical Methods. The main difference between Quantitative Analysis and Technical Analysis is, that quants are not focused on what the market will do in the future, but they will try to develop a trading – investing strategy which can be quantified in the terms of risk, reward and several other metrics.

Machine Learning / Artificial Intelligence

Machine Learning (ML) is a branch of Artificial Intelligence (AI) that has grabbed a lot of headlines lately. Building machine learning strategies and techniques that enable machines to learn in real time, and thus deliver in market conditions, is pretty much the exalted goal of Algorithmic Trading. The notion of a computer that can deliver Forex results time and time again is obviously an attractive concept, and we have been applying some established methods to our systems.

Money & Risk Management

Money & Risk Management are crucial elements of trading the financial markets especially in times of volatility. It is a defensive concept that keeps you in funds so you can trade another day and underpins profitable performance. Money Management is a term used often in the trader community. It involves deciding how large a position to take on trade entry, how to scale into or out of a position, etc. It also involves setting aside enough capital that you can make more than a few mistakes and still not blow up. Risk Management is more of an institutional term and it involves statistical models for such metrics as VaR (value at risk), CVaR (conditional value at risk) and many others. It estimates the portfolio risk across your whole portfolio. At ForthlineFX we have experience with these methods, and can assist you with best practices and speed up your development.

Deployment & Maintenance

The deployment and maintenance of Algorithmic Trading Systems on the dedicated cloud servers is all the rage today. Algorithmic Traders are beginning to come to the cloud as it provides a solution for several traditional problems, such as: Stability (cloud or VPS have almost a zero chance of downtime), low Latency to their brokers (execution speed), Device-independent Access (world-wide) and Security. We can help you in all phases of your EA deployment and maintenance.

EA Development & Trading Solutions

Our Werk

Quality services and products for the FOREX financial community.

We consider each of our clients a true partner, that we are proud to serve and see it succeed. If you are a small investor or a establish investment firm, we can support you.