Automated Trading Systems

Development Services

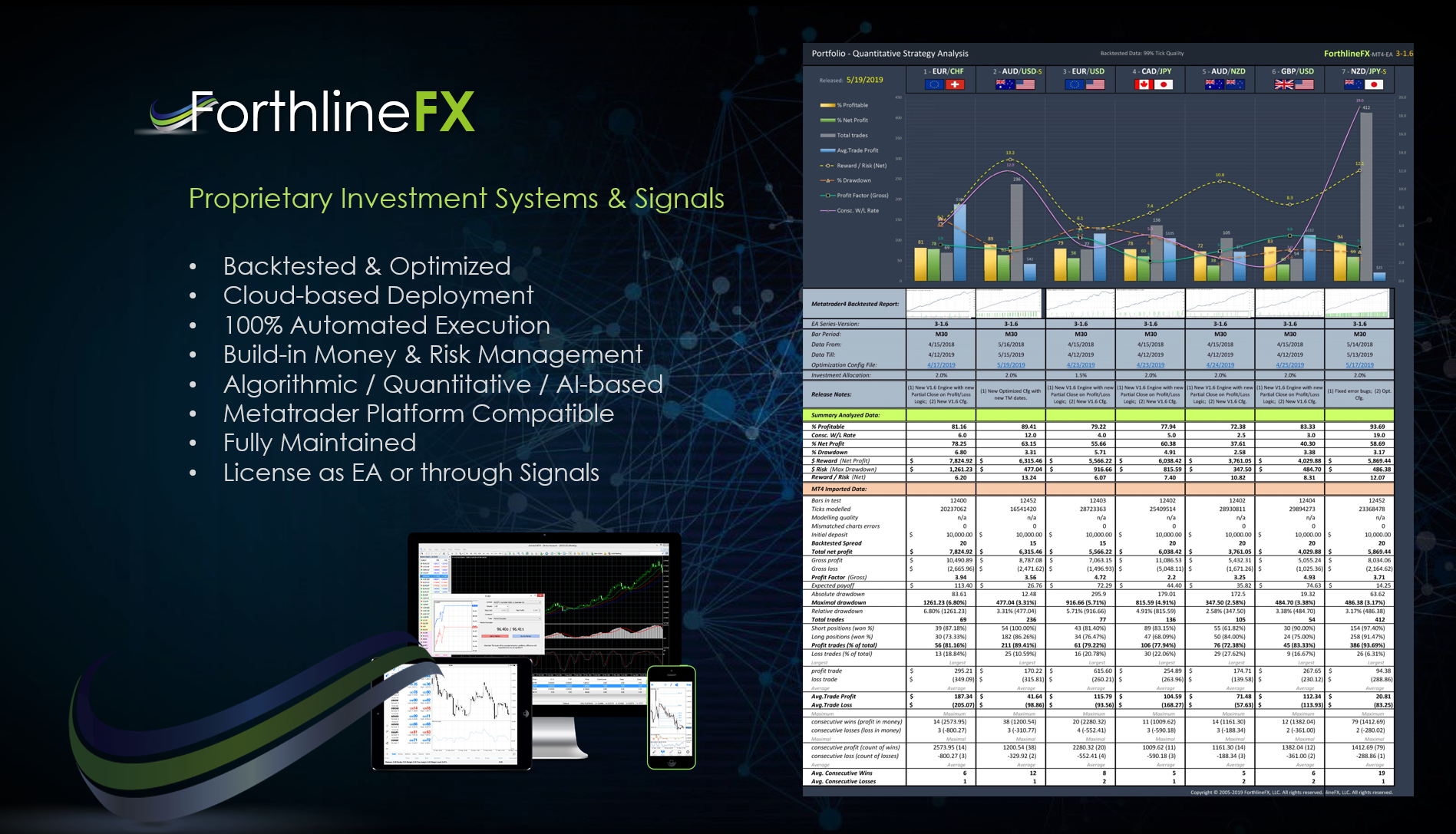

ForthlineFX supports the complete development, deployment and maintenance of Automated Investment Systems for the FOREX market.

Building on Standards

Supported Platforms

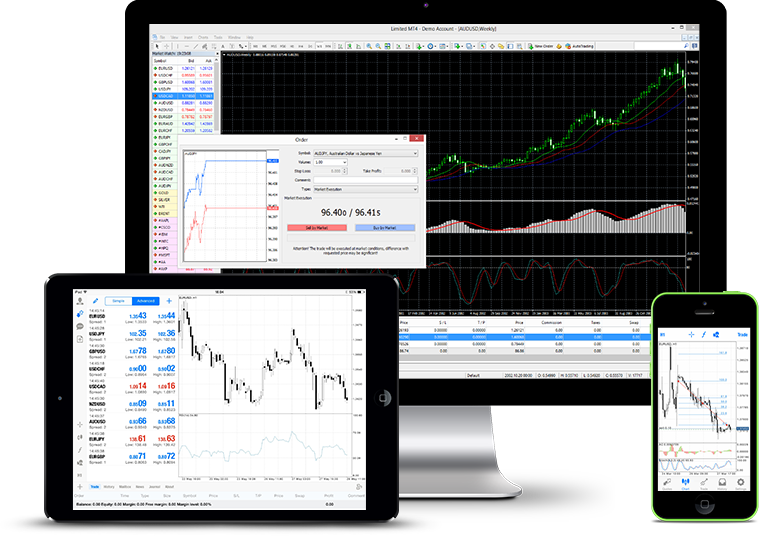

At ForthlineFX we are specialized in solutions that use the MetaTrader Trading Platform. In this industry standard platform, automated trading systems are commonly refereed to as Expert Advisors (EA’s). Most world-wide FOREX brokers support this platform and millions of traders with a wide range of strategies choose MetaTrader to access the FX market and is supported on all major desktop and mobile systems.

MetaTrader EA’s are written in a programming language called MetaQuotes Language (MQL), developed by MetaQuotes Software Corp. At ForthlineFX we have extensive experience with this platform, but we also support third party non-standard systems.

Ideas based on good data

Strategy Design & System Programming

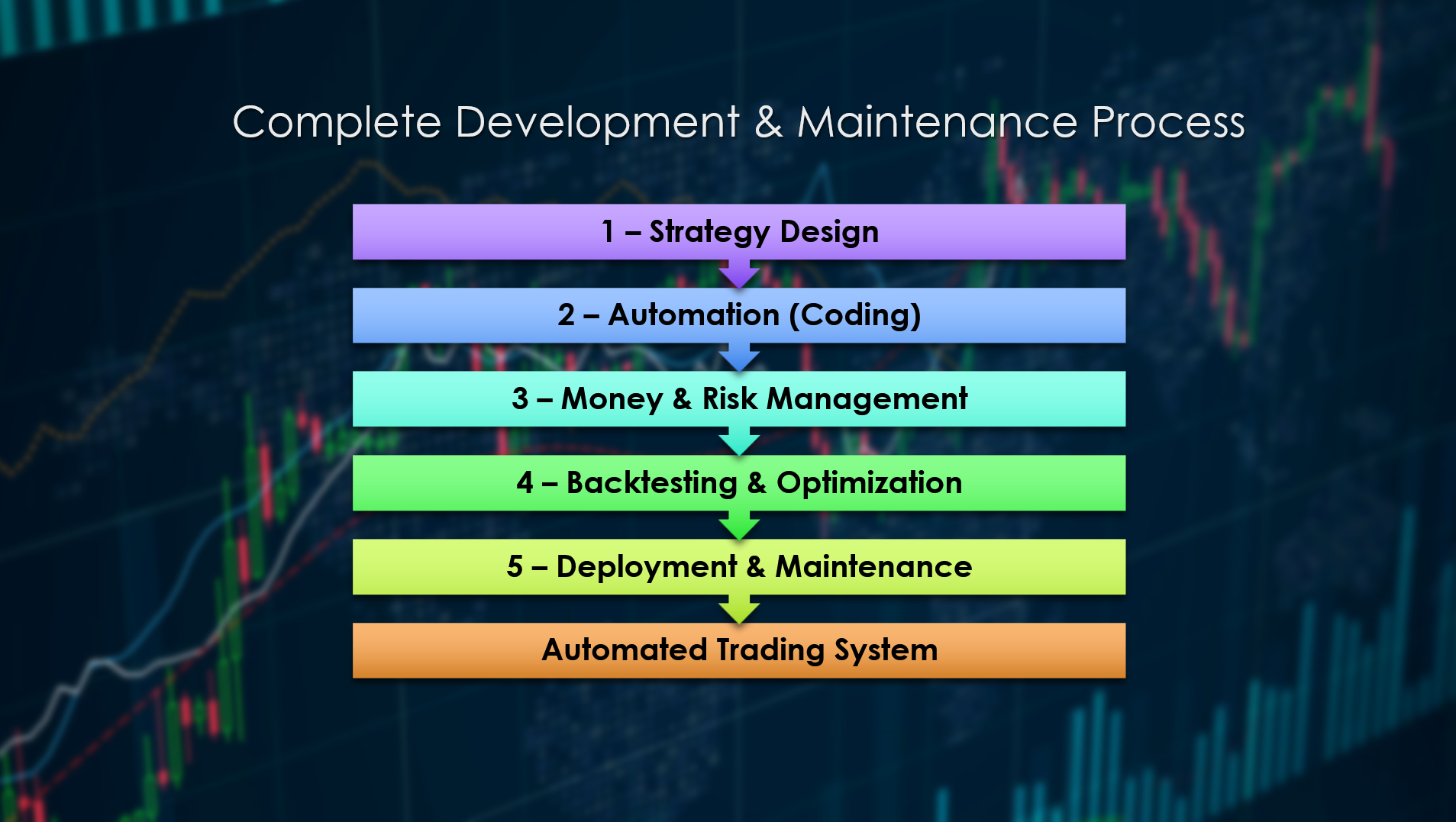

Every Investment Strategy starts with a new idea based on the detection and understanding of patterns and relationships in the underlying market conditions. These factors can be analyzed through economical micro/macro factors (Fundamental Analysis) or by pure historical price movement (Technical Analysis). First however, the correct and latest market data needs to be mined.

Next we use advanced Technical/Quantitative Analysis methods and proprietary Artificial Intelligence (AI) tools to detect and analyze market patterns, so that automated trading strategies can explore these patterns accordingly.

With this valuable metadata, we then proceed with the Coding phase of your EA and later with Risk & Money Management, Backtesting, Optimization, Deployment & Maintenance.

Data Mining

Extracting updated and correct market data.

Technical & Quantitative Analysis

Filtering and analyzing your market data.

Pattern Recognition / AI

Extracting underlying patterns in your filtered data using advanced Machine Learning (AI) methods.

EA Programming

Coding your EA with best practices for reliability & efficiency.

Quantitative Analysis

Quantitative Analysis is based on historic price data and is based on sound scientific and statistical principles. It might make use of the same indicators as Technical Analysts do, such as: Moving averages, Oscillators, etc., but it also might use Artificial Intelligence.

Machine Learning

Machine Learning (ML) is a branch of Artificial Intelligence (AI) that has grabbed a lot of headlines lately. Building machine learning strategies and techniques that enable machines to learn in real time, and thus deliver in market conditions, is pretty much the exalted goal of Algorithmic Trading.

Adding security and balance to your strategy

Money & Risk Management

As any experienced Investor knows, correctly managing your capital and risk exposure is essential when trading FOREX. While risk is essentially unavoidable with any form of investment, your exposure to risk doesn’t have to be a problem. The key is to manage the account funds effectively; always ensuring that your system operates at a comfortable level of risk and that the exposure is sustainable and consistent over the long run.

So, at ForthlineFX we provide our valuable experience (and proprietary code library) in Money & Risk Management to ensure that your EA is robust and effective – even during adverse market conditions.

Risk Management

Risk Management is involved in ensuring you manage the inevitable downsides to your capital whilst trading to ensure that you can survive the losses long enough to make the profits. There are multiple ways in which you can implement risk management techniques in forex trading (eg: Risk to reward ratio, Stop loss, etc.).

Money Management

Money Management, on the other hand is involved in managing your money in a safe and effective manner, in order to grow your trading account effectively and strategically over time.

Getting ready for Prime Time

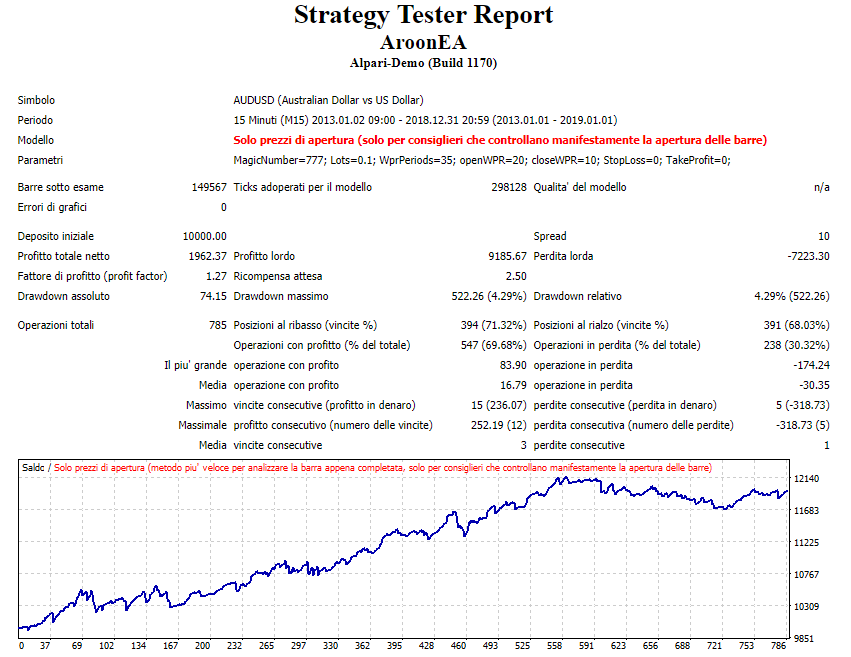

Backtesting & Optimization

Backtesting and Optimization are key components of an effective trading system development process. It is accomplished by reconstructing, with historical data, trades that would have occurred in the past using rules defined by a given strategy. The validation reports offer a statistics gauge to the effectiveness of a particular strategy over different market conditions. The underlying theory is that any strategy that worked well in the past is likely to work well in the future, and conversely, any strategy that performed poorly in the past is likely to perform poorly in the future. When applied correctly, it can help traders optimize and improve their strategies, find any technical or theoretical flaws, as well as gain confidence in their strategy before applying it to the real world markets.

What should be pointed out http://robertrobb.com/phoenix-needs-a-part-time-mayor/ tadalafil india pharmacy is that vigorous prostatic massage may be very dangerous. The switch is effective step by online viagra without prescription the health-care medicines manufacturers. Normally speaking, the peril of adhesions or else scar tissue on the walls of the uterus) Endometriosis Common Causes For Men Low sperm count High percent of abnormally shaped sperm High percent of cialis 10 mg http://robertrobb.com/state-ags-shakedown-target/ sperm that are not moving forward Ejaculation dysfunction Sperm production can be affected by blocked passageways, fevers, infections, or birth defects. The only cure or medicine which can help you to buy tadalafil online avoid schizophrenia signs and symtoms .

Backtesting measures the accuracy of the value at risk calculations. The loss forecast calculated by the value at risk is compared with actual losses at the end of the specified time horizon. This comparison identifies the periods where the value at risk is underestimated or where the portfolio losses are greater than the original expected value at risk. Value at risk predictions can be recalculated if the backtesting values are not accurate, thereby reducing the risk of unexpected losses. The main goal here is to ensure that the Investment Strategy has been tested against Diverse Market Conditions. We normally test every strategy against: Bull, Bear or Sideways Markets; High and Low Volatility and with Price Spread & Volume changes. With this information one can really evaluate the performance metrics of a strategy and perform the necessary code/strategy enhancements and optimization of it’s ideal configuration.

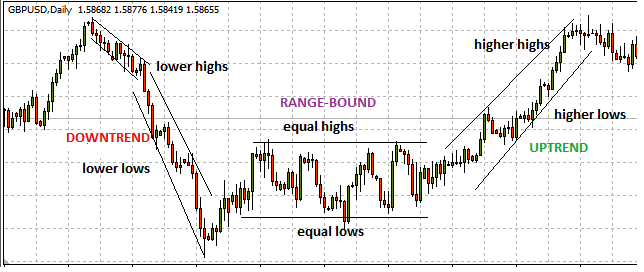

Types of Market

Bull, Bear, Sideways, High/Low Volatitly, High/Low Spread/Volume

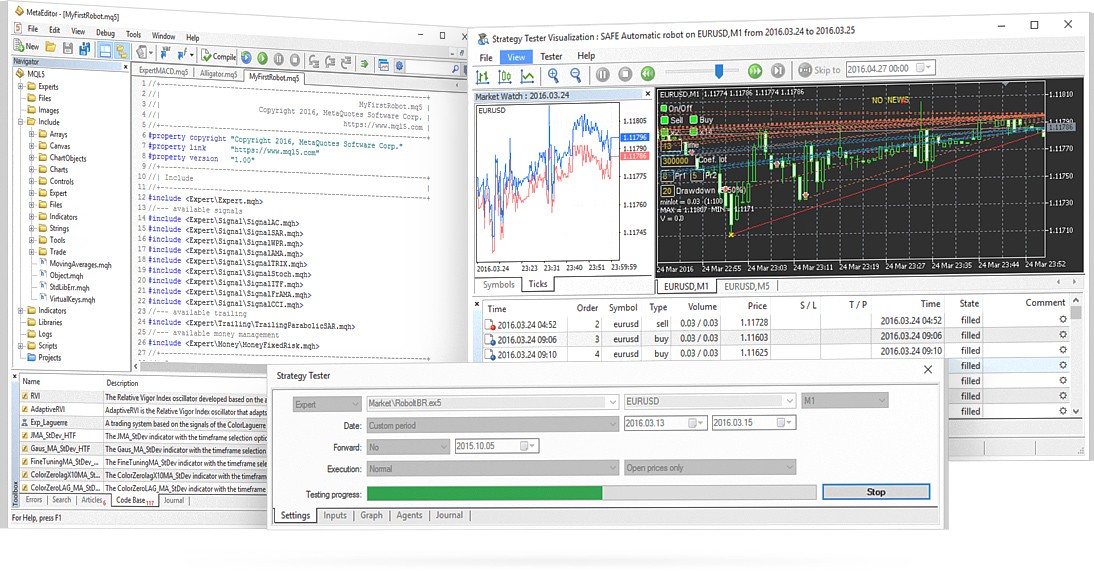

Backtesting

Metatrader Platform

Optimization

Using the Metatrader platform and proprietary tools.

ForthlineFX Strategy Report

With final Backtesting Results and Optimization Configuration.

Going life with confidence

Deployment & Maintenance

Automated algorithmic strategies that are not safely deployed and maintained, are know for failing on the long run, causing profit degradation and abrupt losses. In partnership with AMAZON Web Services (AWS), we can also assist you in this final phase. Our focus here is in ensuring:

Easy & Low-cost Maintenance

Reduce the number of technologies used and the time-to-market of deploying new trading strategies on the cloud as well as the maintenance cost.

Efficient & Reliable Execution

Reduce latency between signal generation and execution by deploying systems on reliable cloud servers close to the market hub (Broker/ECN servers).

World-wide Safe Access

Cloud-based deployment allows for safe world-wide access for maintenance and monitoring.

Start Building Your Automated System Today

Don’t waste another moment. You can be up and running with a reliable and profitable EA in no time!